What Happened This Past Week: Rate Cut & Why Mortgage Rates Still Stung

What Happened Last Week: Rate Cut & Why Mortgage Rates Still Stung

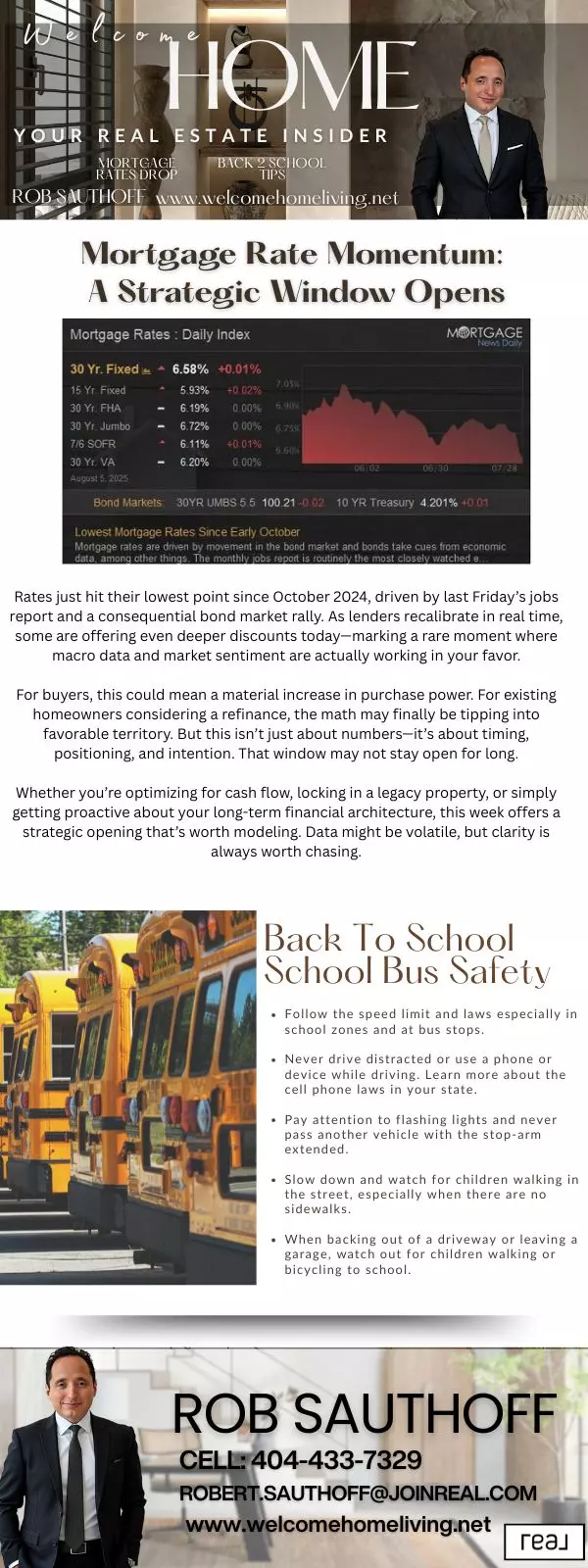

Last week, the Federal Reserve cut its benchmark interest rate for the first time since December 2024, lowering the federal funds rate by 25 basis points to a range of 4.00%–4.25%. The move—welcomed by many in real estate—was framed by Fed Chair Jerome Powell as a “risk management cut.” The labor market is showing signs of strain, inflation remains elevated (though not exploding), and the Fed clearly wants to stay ahead of potential economic softening.

From a real estate perspective, you might have expected this cut to immediately translate into lower mortgage rates. After all, when borrowing gets cheaper, buyers tend to jump in, sellers get more confident, and the housing market gets some oxygen. But here’s where things get tricky: mortgage rates didn’t drop sharply in tandem. In fact, in many cases, they ticked up slightly after the announcement.

The key reason is this: mortgage rates are much more closely tied to long-term bond yields—especially the 10-year U.S. Treasury yield—than to the Fed’s short-term federal funds rate.

That said, the Fed still matters a lot. While it doesn’t set mortgage rates directly, it does set the tone for the entire interest rate environment. When the Fed cuts, it sends a strong signal that borrowing should get cheaper and that it’s committed to supporting growth. That shift in expectations is what filters into bond markets—and eventually into mortgage pricing.

So if bond yields go up (because investors worry about inflation or future risks), mortgage rates follow. If bond yields go down (because inflation eases and growth slows), mortgage rates tend to fall.

What This Means for Buyers, Sellers & the Real Estate Market

-

Buyers: Don’t expect a big drop in monthly mortgage payments overnight, even though the Fed has acted. Some modest relief is possible over time, especially if bond yields moderate. If you’re in a position to refinance, it might pay off, but only if you can lock significantly better terms.

-

Sellers: More affordability could emerge, but until mortgage rates come down meaningfully, demand may stay muted. Sellers that are watching buyer activity should keep an eye on rate movements and bond market signals, not just what the Fed says.

-

Overall Market: Last week's cut is important—it signals the Fed is watching risks and may cut further. But the real lever for mortgage rate relief lies in what happens to bond yields, inflation, and investor expectations. If inflation comes down, economic growth softens in a manageable way, and bond demand remains strong, mortgage rates could drift lower. Otherwise, we’re looking at more volatility.

Categories

- All Blogs (10)

- Alpharetta Real Estate (9)

- Atlanta Local News (8)

- Brand Trust (4)

- Business Insights (3)

- Business Strategy (3)

- Buyers Market (8)

- Dog Heat Safety Tips (1)

- Dog Lovers (1)

- Fed Rate Cut (1)

- First Time Home Buyer (5)

- Fur Baby (1)

- Home Buying Tips (4)

- How To Keep Dogs Cool During a Heat Wave (1)

- Metro Atlanta (9)

- Metro Atlanta Real Estate (7)

- Mortgage Rates (7)

- Pet Safety (1)

- Productivity (1)

- Real Estate (8)

- Real Estate Tips (8)

- Summer Pet Safety Tips (1)

Recent Posts